Value Of Goods Sold: What’s It And How To Calculate

So, when you can cease paying for something and nonetheless make your product, it’s most likely not part of the value of sales. We shall take the total raw materials and labor value for uncooked material as buy value, which is 32,33,230 + 18,88,990, which equals fifty one,22,220. Let us understand the formulation that shall act as the idea of our understanding of the intricate particulars of the cost of gross sales equation through the discussion below. Cost of sales (COS) signifies how much a retail or wholesale business spends on the merchandise it purchases from suppliers for resale. Third, Mary calculates the price of gross sales by adding the worth of goods manufactured to the start inventory of completed items and subtracting the ending stock of finished goods. And when the cups arrive, an worker is liable for putting them on the cabinets and guiding clients in the direction of the purchase.

Each are a half of the income assertion and function key metrics for evaluating the revenue and operational efficiency of a enterprise. The price of sales line merchandise on a company’s income assertion permits buyers to have a first look at the profitability of the production process. The price of gross sales (or generally value of excellent sold) is deducted from a company’s revenue to reach on the company’s gross revenue. Value of goods bought (COGS) represents the direct prices of producing or purchasing the products a company sells, similar to materials and labor. It excludes oblique bills, such as distribution costs and gross sales pressure costs. Understanding these limitations permits businesses to interpret the price of sales figures precisely and make knowledgeable choices primarily based on a comprehensive analysis of their monetary knowledge.

Automate Manual Processes

As a proportion of income, price of sales determines purchasing efficiency. Relying on the type of enterprise you run, you’ll must tweak the worth of gross sales equation for essentially the most accurate outcome. Right Here are instance equations for service businesses, retailers, and producers.

Product-based Corporations (cost Of Goods Offered Or Cogs)

Understanding the excellence between COGS and Price of Sales is crucial for correct financial evaluation and reporting. Calculated by subtracting closing inventory from the sum of opening inventory and purchases. Our partners can’t pay us to guarantee favorable evaluations of their services or products. In the ultimate step, we subtract revenue from gross profit to reach at – $20 million as our COGS figure. Underneath the matching principle of accrual accounting, each price have to be recognized in the same period as when the revenue was earned. The categorization of expenses into COGS or working bills (OpEx) is completely dependent on the business in question.

The Gross profit was reported as higher than in the earlier quarter. The firm reported 230,000 as of the opening stock, 450,000 as closing stock, and 10,50,000 as web purchases. Master the basics of economic accounting with our Accounting for Financial Analysts Course. This comprehensive program offers over sixteen hours of expert-led video tutorials, guiding you through the preparation and analysis of revenue https://www.kelleysbookkeeping.com/ statements, stability sheets, and cash move statements. Gain hands-on experience with Excel-based monetary modeling, real-world case studies, and downloadable templates.

Financial Literacy Issues: Here’s The Method To Enhance Yours

Extra importantly, companies need to calculate the COS to set the right pricing strategies to keep away from beneath or over-pricing. This calculation is essential in various different aspects as well, similar to stock administration, financial reporting, price control, and taxation. A company’s price of income is similar, but not precisely the identical as the company’s value of gross sales or cost of goods offered. The value of revenue includes the entire value of manufacturing the product or service as properly as any distribution and advertising prices. Some companies will use value of gross sales or value of products sold while other corporations will use price of revenue. This choice might shift certain bills to and from the operating expenses part of an organization’s revenue statement.

For companies, it’s important to manage their COS to realize higher income. If your company can cut back COGS by way of a more efficient manufacturing process, it can absolutely turn into extra worthwhile. In addition to uncooked supplies and labor, manufacturing overhead costs also cost of sales definition factor into the price of sales calculator. These overheads encompass a big selection of indirect expenses, including utilities, facility maintenance, and equipment depreciation, all of which play a significant role within the production process. Costs of income exist for ongoing contract services that can include raw materials, direct labor, shipping prices, and commissions paid to sales staff. These items cannot be claimed as COGS with no bodily produced product to promote, however.

- The function of utilizing FIFO is to obviously get a extra correct thought of the present value of products sold, nevertheless it may result in larger taxable revenue when inflation is higher.

- Correct records can give you peace of mind that you are on track come reporting time.

- Now, you might’ve heard of COGS, which stands for Cost of Items Bought.

- Typically speaking, COGS will grow alongside revenue because theoretically, the extra services offered, the more must be spent for manufacturing.

- Whereas we strive to supply a variety of presents, SelfEmployed does not embrace details about each financial or credit services or products.

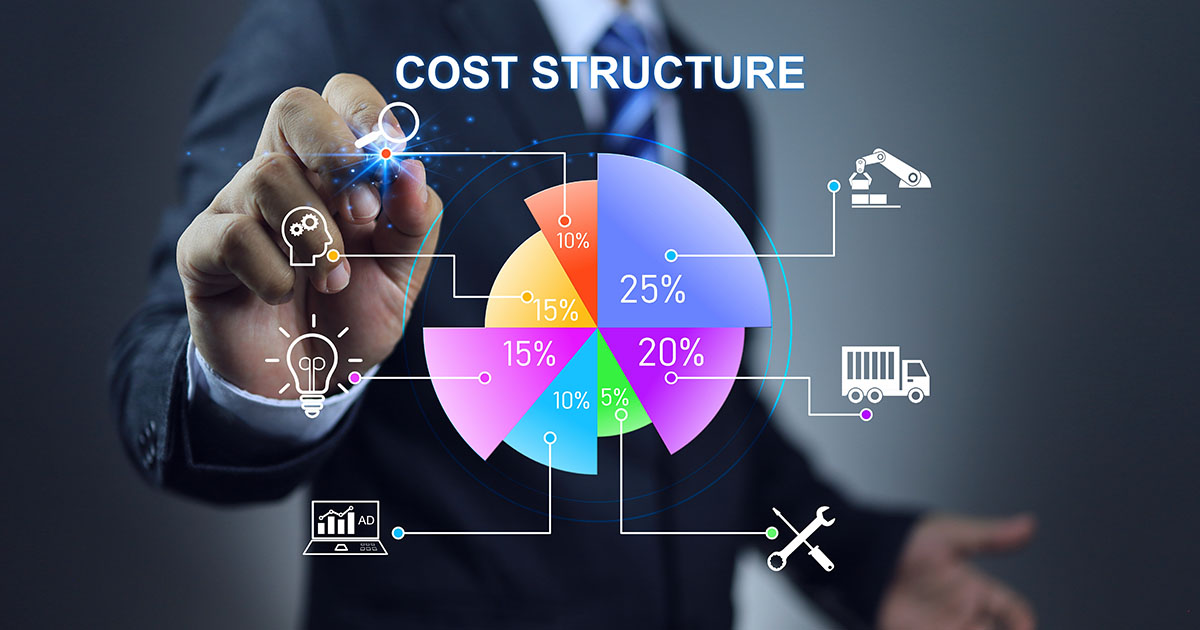

In simple terms, cost of gross sales represents the direct costs incurred within the production course of. It includes expenses corresponding to raw materials, labor, and other direct costs which may be directly tied to the production or delivery of a services or products. By analyzing the price of sales, businesses can acquire insights into their operational efficiency, pricing methods, and profitability. Correct calculation of the worth of sales is essential for monetary reporting purposes, because it supplies important data on the company’s value construction and profitability. It allows businesses to gauge their pricing methods, decide gross profit margins, and make informed decisions relating to stock administration and cost control initiatives. The income assertion supplies a snapshot of a company’s monetary performance over a particular period.