Mastering Forex Trading An In-Depth Course for Success

Mastering Forex Trading: An In-Depth Course for Success

Forex trading can be an exhilarating journey filled with opportunities for those who are armed with the right knowledge and strategies. In this detailed forex trading course, we will guide you through the essential concepts, tools, and techniques that will enable you to navigate the complexities of the foreign exchange market with confidence. Whether you’re a complete novice or someone looking to sharpen your trading skills, this course is tailored to meet your needs. For reliable platforms to start trading, consider checking forex trading course Online Trading Brokers.

Understanding the Forex Market

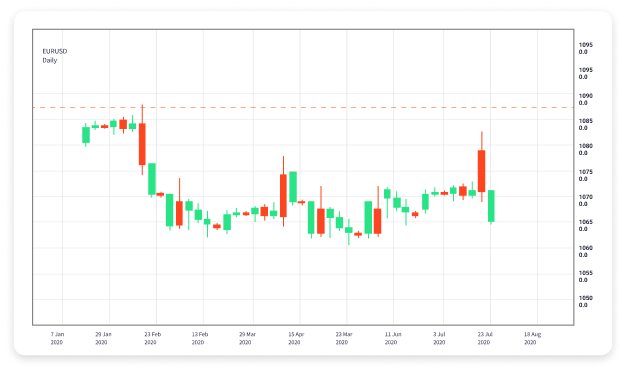

The forex market, known for its high liquidity and round-the-clock trading, is the largest financial market in the world. Unlike stocks, forex trading involves currency pairs, where traders speculate on the value of one currency against another. Understanding how these pairs operate is crucial for success in forex trading. Major pairs like EUR/USD and USD/JPY are typically sought after due to their volatility and volume.

Essential Terminology in Forex Trading

Before diving into strategies and analyses, it’s vital to familiarize yourself with key forex terminology:

- Currency Pair: The quotation of two different currencies, with one being the base currency and the other the quote currency.

- Pip: The smallest price move that a given exchange rate can make based on market convention. For most pairs, this is 0.0001.

- Leverage: A tool that allows traders to control larger positions with a smaller amount of capital. While it enhances potential profits, it also increases potential losses.

- Spread: The difference between the bid price and the ask price. Understanding spreads helps in determining potential profitability.

Technical vs. Fundamental Analysis

To make informed trading decisions, you need to utilize both technical and fundamental analysis:

Technical Analysis

This involves the use of historical price data and charts to predict future market behavior. Traders analyze patterns and indicators, such as moving averages and RSI (Relative Strength Index) to identify potential entry and exit points.

Fundamental Analysis

Fundamental analysis focuses on economic indicators, news events, and geopolitical factors that can influence currency values. Key economic reports such as GDP, employment data, and interest rate decisions play a significant role in understanding market movements.

Developing a Trading Plan

One of the most critical elements of successful forex trading is having a robust trading plan. Your plan should outline your trading goals, risk tolerance, and the strategies you intend to employ. Here are some steps to develop a solid trading plan:

- Define Your Objectives: Decide on your financial goals – are you looking for short-term gains, or is your focus on long-term growth?

- Risk Management: Determine how much of your trading capital you are willing to risk on a single trade. Many experienced traders recommend risking no more than 1%-2% of your capital per trade.

- Entry and Exit Strategies: Outline your criteria for entering and exiting trades based on your analysis.

- Keep Records: Maintain a trading journal to document your trades, strategies, outcomes, and lessons learned.

Risk Management in Forex Trading

Risk management is crucial for protecting your capital and ensuring long-term sustainability in trading. Here are strategies for effective risk management:

- Use Stop-Loss Orders: This tool automatically closes your trade at a specified loss, helping to minimize potential losses.

- Diversify Your Portfolio: Don’t put all your eggs in one basket; diversifying your investments can help mitigate risks.

- Trade with a Plan: Avoid impulsive trading decisions by sticking to your predetermined trading plan and strategy.

Psychology of Trading

The psychological aspect of trading is often overlooked but is vital for success. Emotions like fear and greed can impact decision-making. Here are some tips to enhance your trading psychology:

- Stay Disciplined: Understand the importance of following your trading plan and avoid chasing losses.

- Manage Your Emotions: Accept that losses are a part of trading. Keeping a level head during wins and losses is crucial.

Choosing the Right Broker

The choice of broker is a significant factor in your trading success. Look for brokers that offer competitive spreads, reliable platforms, and good customer support. Don’t hesitate to research and read reviews to ensure you pick a reputable broker that suits your trading style.

Conclusion

The forex market presents numerous opportunities for traders willing to invest time in learning and developing their skills. By understanding the market, utilizing both technical and fundamental analyses, creating a trading plan, managing risks, and honing your trading psychology, you can enhance your chances of success in this dynamic environment. Join our forex trading course today, and take the first step toward mastering forex trading!